Coops vs Condos: 7 Important Differences Smart Buyers Need to Know

Understanding the difference between coops vs condos in NYC is essential when navigating the city's complex real estate market. Knowing how these two types of properties differ will save you time, money, and frustration. In this comprehensive guide, we’ll break down the key distinctions between co-ops and condos—so you can make a confident, well-informed decision when it's time to buy.

what is the difference between a co-op and a condo?

Co-ops and condos differ in the way the properties are financially structured and owned. If you live in a condominium, that means you own the particular unit that you live in. And while you still basically own your unit in a co-op, what you technically own is shares of the corporation that owns your building.

Simplifying the Industry Jargon:

Condo Definition: A condo in New York city is any apartment where individual residents separately own each of their own units.

Co-op Apartment Definition: In an NYC co-op, all residents own shares in the corporation that owns the building.

Is a co-op vs condo easier to buy?

getting co-op approval is more involved

Cooperatives have strict financial requirements. These requirements are dictated by the cooperative board. The board is made up of a group of owners in the building. The board approves buyers only after what can be a lengthy process that includes a full analysis of the applicant’s financials as well as a board interview. Because every co-op has its own unique standards and expectations, it’s essential to work closely with a knowledgeable buyer’s agent to determine whether a co-op aligns with your goals and financial profile. With the right preparation and guidance, the process can be smooth—and co-ops can offer excellent value and a strong sense of community.

Condos Accept more Applicants

Compared to co-ops, condominiums offer a much more flexible and streamlined approval process. While some condo buildings may have basic application requirements or right-of-first-refusal clauses, they generally do not require extensive financial disclosures or personal interviews. This makes condos a more attractive option for buyers who value privacy, speed, or have non-traditional financial profiles. As a result, condo boards tend to approve a wider range of applicants, including investors, foreign buyers, and those purchasing through LLCs—options that are often restricted in co-ops.

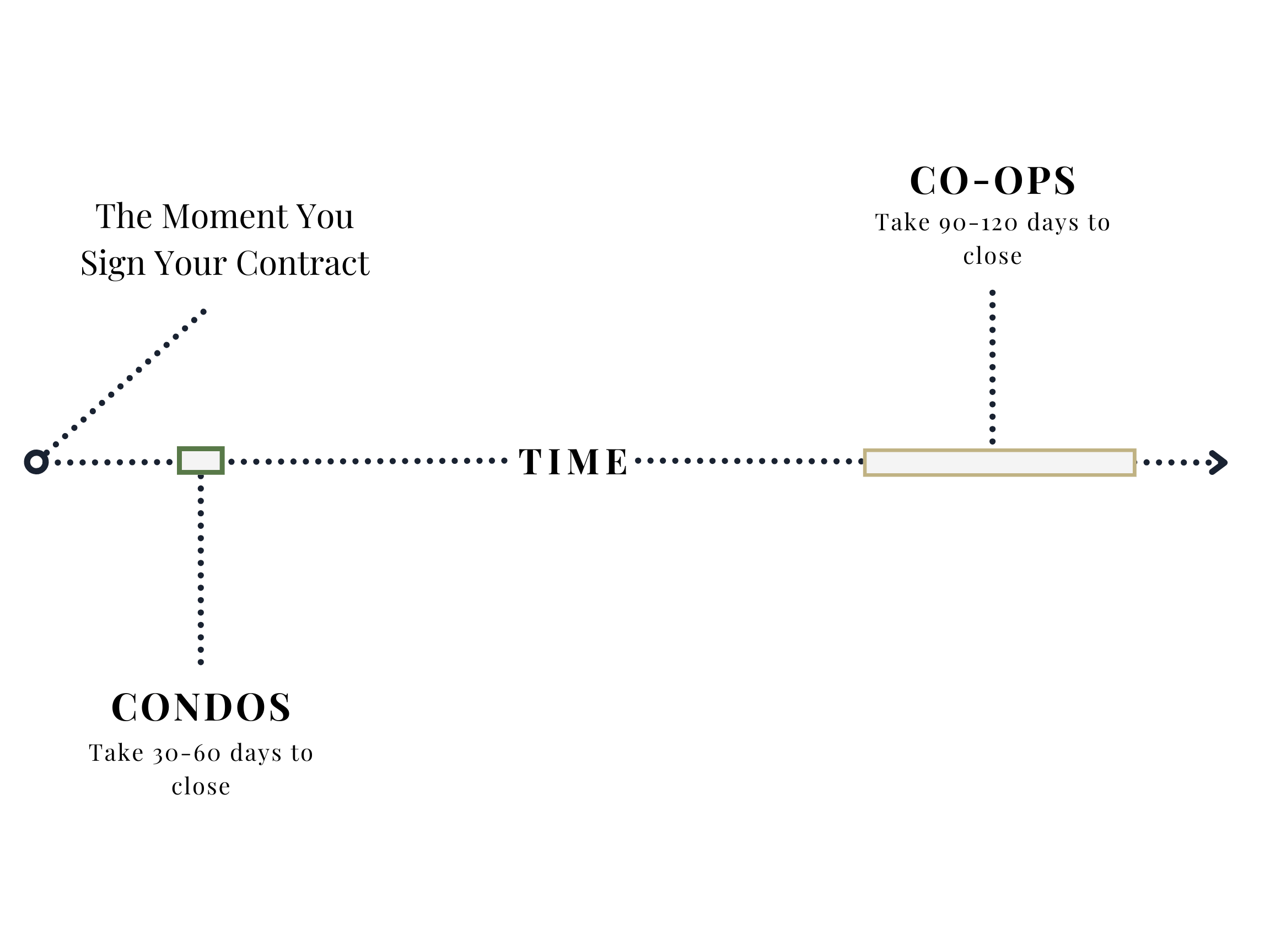

How long does a co-op vs condo purchase take?

Co-Ops Take longer to close

You can typically expect a timeline of 90 to 120 days from contract signing to closing when purchasing a co-op. This window allows sufficient time for the co-op board to review your application, conduct the board interview, and for your lender to finalize financing.

Condos Can Close Quickly

Buyers can close on condo purchases faster than cooperative purchases. In cases where the buyer is paying all cash, it's possible to close in as little as 30 days, assuming the building has a straightforward approval process and all documentation is in order. Even with financing, condos generally offer a faster and more flexible path to closing than co-ops.

Are co-ops or condos more worth the money?

Co-ops offer more bang for your buck

Co-operative apartments are 25% - 30% more affordable than their condominium counterparts. Co-ops are great options for buyers who are looking for more bang for their buck.

Condos are more expensive

Since condos are easier to purchase, they are in higher demand. This drives up prices, even on otherwise comparable units.

The Aesthetic of Coops VS Condos

Pre-war Buildings are almost always co-ops

If you’re looking for a home with classic pre-war charm , you’ll likely end up looking at co-ops. While pre-war condominiums do exist, they are much harder to come by.

If you Prefer modern buildings, look for condos

Almost all new buildings are condos. Since 2015, there have been more than 220 new condos built, and only one new co-op.

Do co-ops or condos require more money up font?

Co-ops require larger down payments

Most cooperatives require a down payment of 20%. Some coops require 60-70% down, and a few coops don’t allow financing at all.

Condos require smaller down payments

Many condos only require 10% down which can make them attractive options for buyers hoping to finance more of their purchase.

Do co-ops or condos give you more freedom?

You have to deal with more restrictions in a co-op unit

Coops vs condos in New York City are known for having stricter rules and lifestyle restrictions compared to condos. Subletting is often heavily regulated, with many co-ops limiting how often or how long a unit can be rented out. In addition, co-ops may prohibit pieds-à-terre (secondary or part-time residences), restrict pet ownership, and disallow purchases through LLCs or trusts. These policies are designed to maintain a stable, owner-occupied community.

Condos give you more control

Condos don’t have restrictions on renting out units, making them a popular choice for investors. In addition, purchases can usually be made through LLCs, trusts, or other legal entities, offering greater flexibility for estate planning, privacy, or investment purposes.

Is it better to buy a co-op or a condo?

Ultimately, choosing between a coops vs condos comes down to your personal priorities and lifestyle needs. A co-op may be the right fit if you value being part of a tight-knit, owner-occupied community, appreciate the charm of a classic prewar building, or want to get more space for your budget. A condo may be a better choice if you’re looking for an easier approval process, the option to sublet indefinitely or to put a lower percentage down.

Making the Right Decision Starts with the Right Resources

Whatever type of unit you’re looking for, it’s always best to enlist an expert early in the process and equip yourself with the right resources. That’s why I created a Free NYC Home Buyer’s Guide to simplify the entire process. It’s designed to walk you through each step of buying in NYC, from financial prep to co-op board approvals. The best part - it’s totally free - Download it today!